A Short History of BIM

The current concept of Building Information Modelling (BIM) has existed since the 1970s and the term ‘building model’ (in the sense of BIM as used today) was first used in papers in the mid-1980s: in a 1985 paper by Simon Ruffle eventually published in 1986, and later in a 1986 paper by Robert Aish – then at GMW Computers Ltd, developer of RUCAPS software – referring to the software’s use at London’s Heathrow Airport.

In fact BAA Plc, the aiport operator was at the leading edge of building modelling from its inception and in 1995 Brad Bamfield, PDSI Director, while Group Development Manager at BAA Plc used an early form to model the construction of the transit systems at Stansted airport with significant success ensuring potential problems were identified before construction with associated cost and time saving.

The term ‘Building Information Model’ first appeared in a 1992 paper by G.A. van Nederveen and F. P. Tolman. However, the terms ‘Building Information Model’ and ‘Building Information Modelling’ (including the acronym “BIM”) did not become popularly used until some 10 years later.

In 2002, Autodesk released a white paper entitled “Building Information Modelling, and other software vendors also started to assert their involvement in the field.

By hosting contributions from Autodesk, Bentley Systems and Graphisoft, plus other industry observers, in 2003, Jerry Laiserin helped popularize and standardise the term as a common name for the digital representation of the building process. Facilitating exchange and interoperability of information in digital format had previously been offered under differing terminology by Graphisoft as “Virtual Building”, Bentley Systems as “Integrated Project Models”, and by Autodesk or Vectorworks as “Building Information Modelling”.

The pioneering role of applications such as RUCAPS, Sonata and Reflex has been recognized by Laiserin as well as the UK’s Royal Academy of Engineering.

As Graphisoft had been developing such solutions for longer than its competitors, Laiserin regarded its ArchiCAD application as then “one of the most mature BIM solutions on the market. Following its launch in 1987, ArchiCAD became regarded by some as the first implementation of BIM, as it was the first CAD product on a personal computer able to create both 2D and 3D geometry, as well as the first commercial BIM product for personal computers.

What is BIM today?

Building Information Modeling (BIM) is a process that begins with the creation of an intelligent 3D model and enables document management, coordination and simulation during the entire lifecycle of a project (plan, design, build, operation and maintenance).

What is BIM used for?

BIM is used to design and document building and infrastructure designs. Every detail of a building is modeled in BIM. The model can be used for analysis to explore design options and to create visualizations that help stakeholders understand what the building will look like before it’s built. The model is then used to generate the design documentation for construction.

Why is BIM important?

According to the United Nations, by 2050 the world’s population will be 10 billion. The global architecture, engineering and construction (AEC) industry is responsible for delivering the social and economic spaces for the global population, and for helping maintain and restore the buildings and infrastructure already in use. The industry must look to smarter, more efficient ways to design and build not just as a means to keep up with global demand but to help create spaces that are smarter and more resilient too.

BIM not only allows design and construction teams to work more efficiently, but it allows them to capture the data they create during the process to benefit operations and maintenance activities. BIM data can also inform planning and resourcing on the project, city or country level. This is why BIM mandates are increasing across the globe.

What is the process of BIM?

The process of BIM supports the creation of intelligent data that can be used throughout the lifecycle of a building or infrastructure project.

Plan

Inform project planning by combining reality capture and real-world data to generate context models of the existing built and natural environment.

Inform project planning by combining reality capture and real-world data to generate context models of the existing built and natural environment.

BIM is now used in Business cases and project justification, Strategic Brief, Appraisals, Brief and information requirements and Supplier appointments.

Information deliverables include model files, documents and structured data files containing information about the facility, floors, spaces, systems and components. Together these create a digital replica of the built asset that starts by representing design intent and matures by the time handover occurs to reflect what has actually been built and installed.

Design

During this phase, conceptual design, analysis, detailing and documentation are performed. The preconstruction process begins using BIM data to inform scheduling and logistics.

Once the contract for suppliers to design (and perhaps construct, and even operate) the development has been awarded, the successful supplier submits a post-contract BIM execution plan (BEP) providing more detail about their methodology, confirming their (and their supply chain’s) BIM capabilities and providing a master information delivery plan (MIDP). The master information delivery plan sets out when project information will be prepared, by whom, using what protocols and procedures – from the supplier’s perspective (the employer’s information requirements sets this out from the employer’s perspective).

The supplier develops the project information model in accordance with the master information delivery plan. They may also develop other information they have identified as important through the course of their activities.

The project information model is developed based upon generic representations with approximate quantities, size, shape, location, tolerances and so on.

Build

During this phase, fabrication begins using BIM specifications. Project construction logistics are shared with trades and contractors to ensure optimum timing and efficiency.

During this phase, fabrication begins using BIM specifications. Project construction logistics are shared with trades and contractors to ensure optimum timing and efficiency.

The successful contractor submits a post-contract BIM execution plan (BEP) confirming their (and their supply chain’s) capabilities and providing a master information delivery plan (MIDP). This should take into account existing BIM execution plans from suppliers already appointed (such as design consultants), and may include BIM training requirements for the contractor and their supply chain.

The contractor will need to establish or prepare information such as:

- Schedules of conditions of existing and neighbouring structures

- A master programme for the construction works.

- A project handbook setting out responsibilities, procedures, and lines of communication for the construction stage.

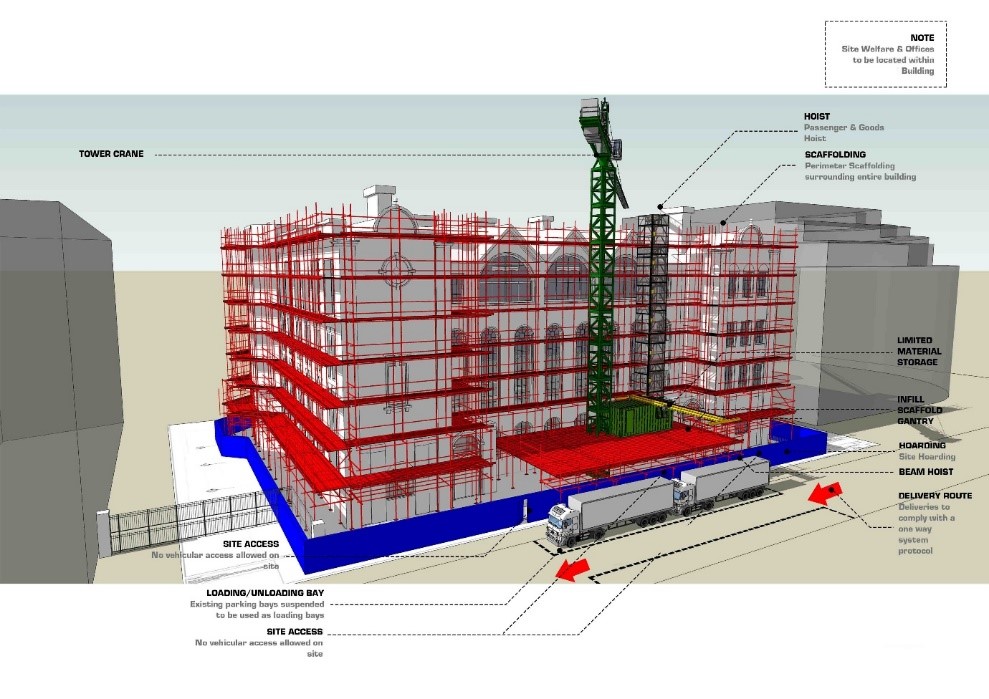

- A site layout plan for construction.

- A contract register.

- An asset register scheduling assets on site and who they belong to.

- Statutory site registers

- Any further survey work

- Statutory utilities

- A construction phase plan.

- A site waste management plan.

- Site logistics an traffic management plan

Operate

BIM data carries over to operations and maintenance of finished assets. BIM data can be used down the road for cost-effective renovation or efficient deconstruction too.

BIM data carries over to operations and maintenance of finished assets. BIM data can be used down the road for cost-effective renovation or efficient deconstruction too.

An asset information model (AIM) is developed from the as-constructed project information model (PIM), or the PIM is used to add to an existing AIM. The asset information model compiles all the data and information related to, or required for the operation and maintenance of the completed development.

The model may be developed to include information from post occupancy evaluations, metered performance information, actual in-use costs, remote monitoring information and so on. Object information in the model may be developed to include operational information such as maintenance records and replacement dates. There may be two-way connections between the model and enterprise systems used by the employer, such as purchasing systems, performance reporting systems and work scheduling systems.

All this may seem complex (and we have only provided the headlines here) but BIM is an essential management process for successful delivery of your project from inception to decommissioning at end of life.

After all why would you invest so much money and management time in your project and not use the best planning, design, construction and operation processes available?

We have seen BIM save clients significant amounts of money by identifying problems or design issues early, delivering on time completion and effective buildings for use. BIM should never be considered a “cost” but a value added component of your project.

Finally if you are considering a project require BIM from your designers, suppliers and contractors good companies are happy to provide it whereas any resistance tells its own story.

Why choose Profile for your BIM requirements?

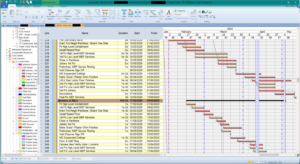

Profile Construction Consultants Ltd are recognised throughout the Construction Industry as leaders in Construction Planning, providing valuable Planning Services for all stages including Claims and Adjudications of any given Project to a myriad of contractors and subcontractors alike.

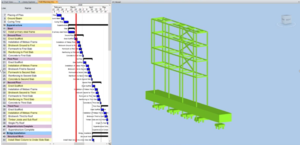

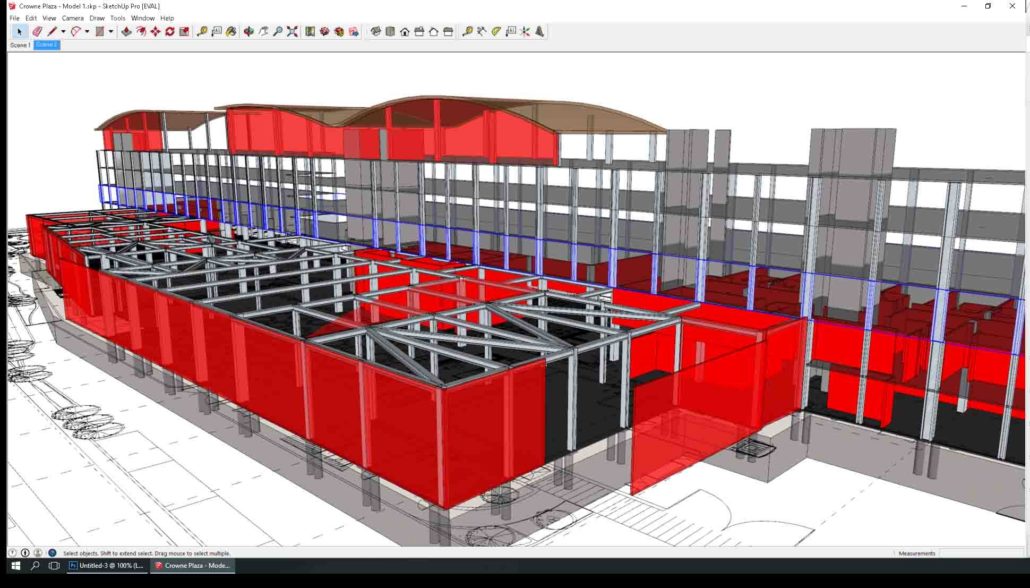

Combined with our 25 years of experience, we also specialise in 4D Planning and can offer all your 4D BIM requirements bespoke to your needs and budget.

Instead of purely trying to interpret a Construction Programme we can link your 3D models directly to the programme thus allowing you to see various digital live simulations or what if scenarios of your 3D model with time implemented which is crucial to any given project.

By appointing Profile for your 4D Planning you can:

By appointing Profile for your 4D Planning you can:

- Lower risks by rehearsing and optimising the Construction Process at Pre-Construction stage and find the best solutions early.

- Streamline your Construction Process and see the potential of all members of the team communicating with a common language – the 4D Model.

- Clearly identify potential delays and clashes early throughout the Construction Period.

- Report progress in a better and intuitive manor by visually simulating the planned vs as built.

- Clear and easy interpretations for Claims and Adjudications.

- And more…

Profile believe BIM is the next step in the industry towards a better, safer and more efficient Construction Process.

Contact us here

![]() Initiate Consulting Ltd, part of the PDSI group, are please to confirm the result of a recent audit by BSI. We passed the audit with no non-conformities raised and have been re-certified against ISO 9001:2015 for further 4 years (subject to annual reviews).

Initiate Consulting Ltd, part of the PDSI group, are please to confirm the result of a recent audit by BSI. We passed the audit with no non-conformities raised and have been re-certified against ISO 9001:2015 for further 4 years (subject to annual reviews).

:

: